By Murray Wennerlund published 3-29-2023 updated 3-29-2023

|

|

By Murray Wennerlund published 11-14-2018 updated 6-5-2019

By Murray Wennerlund published 11-14-2018 updated 6-5-2019

Part I of IV based on: "Flood Insurance Requirements"

Homeowners where sent a letter informing them they needed to increase their NFIP flood insurance to match at least the Restore Louisiana Grant awards also known as "Program Costs". This letter in Part II of this series was sent 30 days after the unannounced Homeowners Policy Manual was changed Oct. 5, 2018. This blindsided both case workers, homeowners and task force members. So who was responsible for this whole 30 day demand to increase flood insurance or be deemed ineligible for HUD Program grants?

It is estimated that thousands of flood victims will have to provide proof of flood insurance covering the total project grant award and project cost by the middle of December 2018 or they will be deemed ineligible and dropped from the Restore Louisiana Program by the States OCD-DRU and it's state contractors.

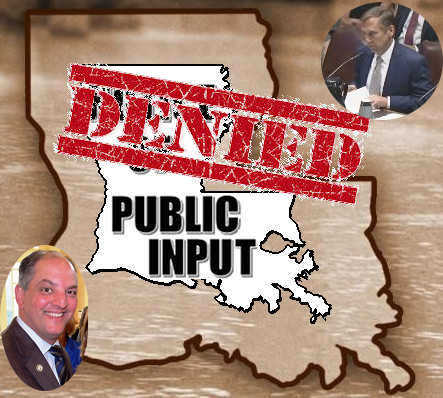

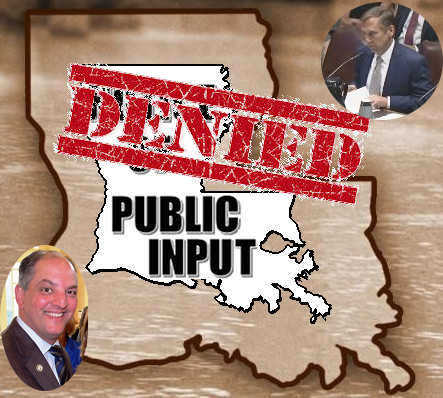

After review of the issue and research it appears the State of Louisiana OCD-DRU and it's sub-contractor IEM Inc. incorrectly processed homeowners and signed grants without verifying that the homeowner was carrying enough Flood Insurance according to FEMA NFIP policies to cover the full project costs. It also seems as if the state was scrambling to correct this issue by updating without public notice the Homeowners Policy Oct. 5, 2018. We find no policy with HUD that requires a homeowner to become compliant within 30 days once the grant was executed by the state of Louisiana. In fact our research in the 4 articles will show you clearly that it was a mistake by the State of Louisiana Office of Community Development - Disaster Recovery Unit and it's sub-contractors to include quality control, and policy review.

The state posted no advance notice of the policy change that was made public for the first time Oct. 5, 2018 in the Homeowners Assistance Manual version 4.0 Section 5(a) adding the line, "The full insurable value of the structure will be based upon the Program's final total project cost for the applicant." which applies retroactively to every solution 1, 2 and 3 household.

Modification of the policy to this degree requires HUD approval based on the percentage of applicants in a single group that the policy affects. In this case the homeowners assistance program may have more than 6% of it's approved members affected by this unannounced policy change.

This type of modification is typically announced to the public at the Louisiana Homeowners Task Force meetings. We have no record of any such meeting published to the Louisiana Boards and Commissions website nor to the Restore.LA.Gov media or news sections.

Following HUD Policy regarding changes to Homeowners Assistance any change of this magnitude should have been presented to the Louisiana Homeowners Task Force and allowed an open public comment period of no less than 15 days.

Technical Details of the Oct 5, 2018 Homeowners Assistance Program Manual Version 4.0 (Includes 4.1)

How the flood insurance policy Section 5(a) read in all 2018 updates prior to Oct. 5, 2018:

"... flood insurance in the amount of the lesser of: (i) the full insurable value of the structure as determined by the applicable property insurer, or (ii) the maximum amount available for the structure under the National Flood Insurance Program, or a successor program."

Modified Section 5(a) by adding the following line:

"The full insurable value of the structure will be based upon the Program's final total project cost for the applicant."

Change log of Policy Manual version 4.0/4.1

"Edited Sec. 5(a) to include the language: "The full insurable value of the structure will be based upon the Program's final total project cost for the applicant."

Please address this issue with your Louisiana Task Force Members, State Congressional Representatives, and State Legislators.

Part I of IV based on: "Flood Insurance Requirements"

Update 11-21-2018: State of Louisiana Director of the Office of Community Development claims information is "...completely incorrect..." Please read our evidence post and our reply to this unfounded accusation by the director appointed by Governor Edwards to the State of Louisiana Office of Community Development - Disaster Recovery Unit.

Follow this link to Part II Pay Up or Get Out, You have not provided evidence that you are maintaining sufficient flood insurance.