Comment: Insurance will be needed or you will get nothing. But even then you will need to know how to navigate a system that the states create to make it impossible for them to navigate. Insurance required to cover federal assistance received.

Financial disaster recovery planning team within the Administration grant funding.

OCD-DRU trainer for all county, parish, city, town planning and zoning departments for HUD compliance training.

Resource: HUD OIG Report 2013-FW-0001

>> Start snip of report page 19,20 <<

Some States Did Not Take Sufficient Steps To Protect the Invested Federal Funds

Some States did not require adequate homeowners' insurance for the homes built or rehabilitated with Disaster Recovery funds. Texas initially did not require insurance. It modified its program for the Katrina, Rita, and Wilma second allocation and, along with Louisiana and Florida, required insurance for 3 years. Alabama adopted a deed restriction that "strongly encouraged" insurance. For the Gustav, Ike, and Dolly allocation, Texas again modified its program and stated insurance was required, but its policy, like Alabama’s deed restriction, stated only that failure to maintain insurance "may" impact future disaster assistance. However, Mississippi took an aggressive stance by requiring a transferable covenant that required insurance at all times. These variations occurred because HUD allowed the States maximum feasible deference in the implementation of their Disaster Recovery programs as allowed by the State CDBG program.

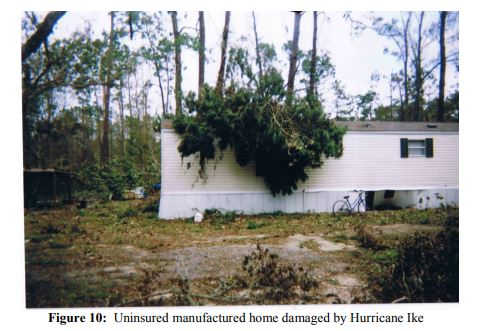

HUD needs to adopt a best practice to address the issue of insurance to ensure that the Federal funds invested in the assisted homes are protected in the event of future hurricanes or disasters. Since Hurricane Katrina in 2005, an additional 10 hurricanes and other storms have hit the States and caused damage. Further, our audit of Texas13 found that Hurricane Ike had damaged homes repaired or replaced by Katrina, Rita, and Wilma grant funds, which lacked insurance. In one extreme case shown in figures 10 and 11, an uninsured home suffered significant structural damage, and the homeowner inquired about additional disaster assistance for his recently replaced home.

The Texas audit also found that of a sample of 59 Katrina-, Rita-, and Wilma funded homes tested, 38 homes were later damaged by another hurricane or storm. Of the 38 homes, 23 did not have insurance. Based on a projection of the sample results, at least 133 of 453 reconstructed or rehabilitated homes or homes awaiting reconstruction lacked insurance and were damaged or are at risk of being damaged by another storm. The report concluded that if Texas changed and improved its action plan and policies, an estimated $60.2 million in program funds could be saved.

For Hurricane Isaac, which struck in August 2012, initial reports estimated damage to 13,000 homes in Louisiana located in the same areas previously affected by Katrina. Since Louisiana required insurance for only 3 years, there is the potential that damage had occurred to Disaster Recovery-assisted homes completed before 2009 that may lack insurance, as the State's required insurance period had expired and nothing would prevent homeowners from seeking additional Federal assistance.