By Murray Wennerlund published 3-29-2023 updated 3-29-2023

|

|

By Supervisor published 5-13-2018 updated 6-21-2018

By Supervisor published 5-13-2018 updated 6-21-2018

Copy of Action Plan Amendment 8:"This Action Plan Amendment (APA) also creates a new program, the First Responders Public Service Program, in order to address the unmet needs caused by a reduction in revenue received from ad valorem taxes following the reassessment of properties in the aftermath of the 2016 floods. Funding for this program is coming from "Administration and Other Planning Activities" funding category. The recovery of a community, and therefore the housing recovery, cannot be fully realized without a normalization of such fundamental public services. Storm-impacted homeowners and renters rely on the services provided by local sheriff's offices, fire districts, emergency medical services and other emergency first responders to keep them safe. Therefore, maintaining an adequate level of first response services is a critical component of a community's recovery, particularly as homeowners and renters work toward returning home."

1. Administration and Other Planning Activities, no report has been published to show that Planning activities are complete for our DR4277 and DR4263.

City Planners often Plan for lower Tax Revenue after disasters. Most cities ask their population not to ask for reassessments during this time of disaster so not to force a cut to city services.

City planners in California are looking at slow tax revenue collections for a couple of years but with retail sales tax combined to the building of new homes to replace those destroyed by wildfires of equal or greater value they are not worried about the long term tax loss.

Property tax relief came to many in the top 10 parishes directly from the tax assessors office. You didn't have to file for property tax relief. Some have lower home values but would have not opted for lowering property taxes if the citizens were informed about the long term effects. Most cities and some parishes have acquired SBA Loans or at least have been approved for loans to cover services that tax review drops would stress. The City of Denham Springs has $5,000,000.00 in low interest and forgive loans other cities have similar if not greater loan options.

If each parish / city assessors office would have made it a requirement to request property tax relief the global tax cut would not have been needed. Many may have had tax cuts for undamaged homes from what I understand and how the survey was conducted.

Local government should be able to rebound with retail sales taxes as well as the increased in rebuilds completed. According to FEMA reports on renters assistance and manufactured homes very few people are not back into their homes.

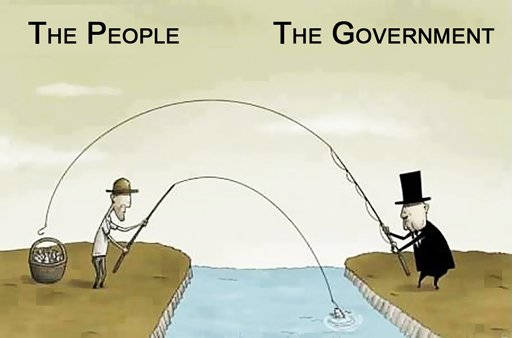

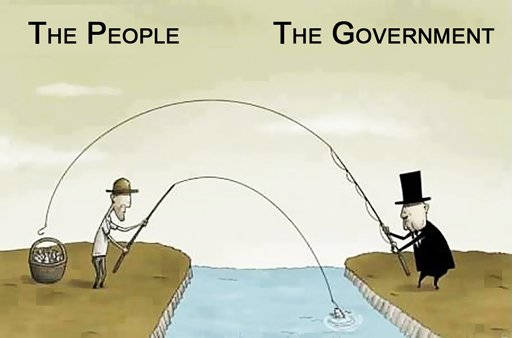

It is the governments responsibility to have a financial plan for disasters that will last longer than 2 years. Cities and parishes that have not properly planned for disaster long term disaster should not be given financial aid that was directed to assist the tax base in the first place.

$66,278,880.00 was awarded for Administration and Other Planning Expenses which could total 20% of the total allocation by congress. The total allocation number: $1,708,407,000.00. If this program does not require additional funds or was for reasons we do not know about over funded the funds should be returned and allocated by need which is not to bail out local governments temporary financial setbacks but to assist homeowners in rebuilding and reconstruction of their disaster damaged homes.

Budget change summary: The state has identified efficiencies in its implementation of disaster recovery programs and therefore is reallocating a portion of its Administration and Other Planning Activities budget to the newly created First Responders Public Services Program to address the unmet needs related to the provision of those critical services.

Program Summary: The First Responders Public Services Program is being created in order to address the unmet needs caused by a reduction in revenue received from ad valorem taxes following the reassessment of properties in the aftermath of the 2016 floods. This program will provide grants for operational assistance necessary for these types of service providers to provide the levels of service that were projected and provided before the Great Floods of 2016.

In the State of Louisiana, properties are assessed at least every four years by the assessor's offices to determine property value. The last statewide assessment that was conducted prior to the 2016 floods occurred in the 2012 tax year. A reassessment of properties took place after the flood and as a result, the value of the reassessed properties greatly reduced due to the damaged state of the properties affected by the floods. Consequently, the revenues of many first responder agencies dependent upon ad valorem revenues were impacted negatively due to the reassessed property values, which impacted the level of services these agencies provide. Preliminary research shows that these agencies had to reduce staff, reduce the purchase of necessary equipment and reduce staff training due to the reduced revenue that was projected to be higher based on pre-storm projected ad valorem taxes for the year.

In order for communities to recover from the long-term effects of the disaster, it is imperative for such emergency public services to be fully staffed and operational. Without fully operational first response services, the safety of homeowners and renters is at risk, which will have a direct impact on the recovery of Louisiana's impacted neighborhoods. Many homes remain partially improved or fully damaged, placing them at higher risk of break-in, vandalism and fire. Furthermore, as residents continue through the emotional and physical stresses caused by such a disaster, their personal safety and access to swift and responsive emergency services becomes more critical not only for their immediate health, but also as they make decisions about where to live.

Administering Entity: Local subrecipients, units of general local government and/or agencies within units of general local government

Proposed Use of Funds: The First Responders Public Service Program will assist public first responder agencies in the ten (10) most impacted and distressed parishes with operational funding for these entities to provide pre-storm projected levels of service. Eligible uses of assistance include payment of salaries and benefits, purchasing equipment, training and other identified eligible unmet need uses.

Eligible Applicants: Public first responder agencies, units of local government

Criteria for Selection: Assistance from the First Responder Public Services Program is limited to entities that meet the following criteria:

Method of Distribution: The state will solicit applications from first responder agencies and local governments in the ten most impacted and distressed parishes to identify the universe of potential recipients. The state will analyze the applications for a demonstrable and quantifiable unmet need. Assistance will be provided for one year of operations; however, the state may provide assistance after the first year if the state assesses a continued and critical unmet need after providing assistance for the first year. If the program is oversubscribed, the state may issue awards on a prorated basis.

Maximum Award: The program will provide awards in the form of a grant, with a maximum grant of $3 million. If the program is oversubscribed, the state may choose to prorate award amounts to eligible applicants.

Per the state's initial Action Plan, this Amendment is considered substantial as it as it substantially amends program budgets and creates the First Responders Public Services Program. The formal public comment period for the amendment begins Wednesday, May 2 and runs through Tuesday, May 15 at 5 p.m. CST. Citizens and organizations can comment on this amendment via:

The plan is available in Vietnamese and Spanish to reach the limited English proficiency citizens in the impacted areas. Citizens with disabilities or those who need other technical assistance can contact the OCD-DRU office for assistance via the methods listed above.

--------------

I strongly oppose the creation of a First Responders Public Services Program until a study by service area has been completed and demonstrates that funds are only temporary and that each service area has a long-term financial budget based on accurate and current data related to their respective ad valorom tax base. We must focus on long-term sustainable services. If ad valorom taxes do not return to pre-flood levels this program would be granting money to unsustainable government-managed services resulting in government waste.

If a program as outlined in the request for public comments (First Responders Public Service Program) was created, we must place stringent restraints on funding. Funding will only be applied in the amount of the actual tax reduction directly caused by the 2016 floods. Recipients of the grant funds must be obligated to provide evidence using certified accounting practices that a reduction in ad valorom taxes has directly impacted their service area, and there is no other recourse than to ask that State of Louisiana previously allocated grant money to create a new grant program to offset the deficit directly related to the DR4277 (August) and DR4263 (March). We must put into place controls that ensure grant bailouts are due to reduced ad valorom taxes because of the disaster and not prior mismanagement of funds.

It's important to clarify what the funds will be used for before allocations are made. If funding is for daily operations, a budget forecast must be provided by the recipient detailing long-term plans that may also include requirements for reduction of services to match ad valorom tax revenue.

If no long-term plans are in place, we must then take the position that a service reduction to match ad valorom tax revenue is in place and grant funds will be used to temporarily assist the service area in downsizing service requirements.

It is the responsibility of the individual service areas to adopt recovery plans that include the reduction of ad valorom taxes. It is not the responsibility of the federal government, state government, or the Louisiana Task Force to take interest in or otherwise assist in the balancing of localized budgets for any geographical area.

The Task Force has not addressed individual household financial status nor has a study been conducted to verify that ad valorom taxes will return to pre-flood levels within any given time frame. Based on progress reports provided by RestoreLA, we can expect a slow recovery for homeowners which directly effects ad valorom tax base. It should be a requirement that all grant applicants for the First Responders Public Service Program provide a detailed plan of their expectations to return to previous normal tax levels based on their service area tax base. If service levels are not expected to return to normal, we would then need a plan showing service reduction and funding distribution during their service reduction period.

Criteria for Selection:

• Pre-flood financial reports should be provided to prove pre-flood programs were sustainable by the public first responder agencies and units of local government. We do not want to fund a poorly managed agency or local government looking for a grant bailout.

Method of distribution:

• Assistance will be provided for 12 months of operation starting from the actual time ad valorom tax based revenue had declined. If any money was redirected within the agency or local government to keep active services balanced that agency should be refunded by the first responders agency or local government. This is not to include any expense other than day to day operational expenses.

• If assistance is required for an additional period beyond the initial 12-month cycle, a new review and application will be required to show ad valorom tax base revenue forecasts and departmental proposed cutback for long term sustainability. This program is not to be used as a bailout due to permanent population decline or ad valorom tax decreases. Long term solutions should be in the form of local government cutbacks in services due to the decline in service need by population shifts or reduction in taxable assists and land values.

Is it in the best interest to the population and homeowners who generate the highest levels of ad valorom tax revenue for public and government services that the Task Force consider de-funding currently-funded projects like the Administration and Other Planning Activities fund and not focus the money toward other active programs that are known to be underfunded since January of 2017? The Homeowner Program is under-funded and is the long term solution to the issue of a declining tax base in the 10 most impacted disaster zones.

The First Responders Public Services Program grant does not guarantee that homeowners will rebuild and revitalize the ad volorem tax base.

If we apply funds from the Administration and Other Planning Activities to current programs known to create ad volorem tax base for public services we create a long term solution to our disaster recovery issues.

We all agree we need to support our First Responders and our Public Services which when we look at local government can also include our sewer services which also has a deficit directly related to our ad volorem tax base. First responders, medical, fire, police have a deficit due to the disaster. Government departments and agencies have deficit due to the disaster. Households have a deficit due to the disaster and it's households ad volorem tax base that fuel our first responders, fire, police, government departments and agencies. Without households owning properties at pre-flood values added to the tax base we have no long term solution. Without households localized spending in our individual service areas decreases effecting local government services. We need to invest the grant money in areas that will provide the most long term revenue to the community. We need to focus on providing the funds to rebuild and invest any additional grants and overages to our Homeowner Programs designed to assist homeowners with disaster repairs. This is the only logical path to a sustainable public service and community government service programs.

Calculations should be by percentages and maximum grants should also be limited by a percentage of service support required to keep service levels matching current tax base recovery. Local government agencies that have deferred tax responsibility should not be able to exclude this liability on the remaining tax base. Each local government will need to provide the estimated tax revenue for each business that the local government allowed to be tax exempt or to have a tax reduction for its business recovery plans.

Thank you for your time.

OPTIONAL: Awards should only be granted on a prorated basis with current active service levels compared with current service infrastructure capacity in conjunction with departmental cutbacks in preparation for slow recovery within the tax base.

OPTIONAL: Maximum Award: It is unrealistic to provide a maximum grant of $3,000,000.00 when your expected program in its basic plan will run for one year with its first funding of $8,000,000.00 covering 10 potential service areas.

--------------------------