By Murray Wennerlund published 11-16-2024 updated 11-16-2024

|

|

|

By Murray Wennerlund published 10-4-2022 updated 10-4-2022

By Murray Wennerlund published 10-4-2022 updated 10-4-2022

Summary early publication of this article.

It appears the new risk management system will end up costing more to areas and communities who do not mitigate after each major or severe disaster.

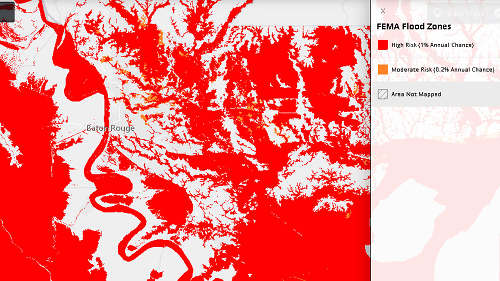

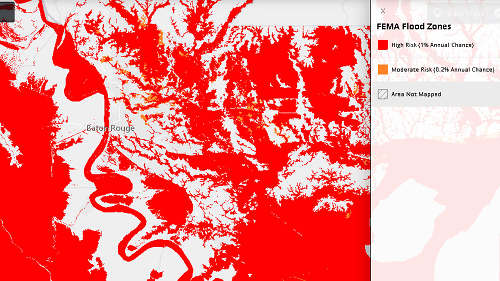

This means when your home is flooded and you do nothing to prevent future floods the costs will go up so you can cover your own recovery via premiums. Also, if you build or rebuild in a Special Flood Hazard Area (SFHA) your rates will be higher than those in non SFHA.

The rate formula's are all logical based on the risk of flooding instead of using the method of "Chance of Flooding."

The National Flood Insurance Program is a failing program costing more to the American taxpayers in ways most congressional representatives are unaware of. Or if they are aware, they use the system to promote profiteering at the state level.

I will be updating the issue I have noticed with getting the word out on what is the best elevation standards to use. Here in Louisiana most parishes are still saying you only have to build up to Base Flood Elevation (BFE) based on the FIRM data. That method of thinking is going to cost you each and every year your home is occupied. The Risk Management method actually shows price discounts for BFE, BFE+1 foot, BFE + 2 feet, BFE + 3 feet. After BFE + 3 feet there are no longer any discounts. Then it goes into what area your home is located in. Are you in a floodway, within a specific distance of a river, storm or tidal surge, or simply living in a SFHA or even a spillway environment will tack more costs to your home than a home not in the flood prone areas.

Land in Louisiana that hasn't flooded will end up costing you more than it's actual market value because of the savings you would have with Risk Management 2.0 NFIP pricing. But is the cost tradeoff worth it? In many cases the answer is No, why would it concern me to move to a more expensive area to save $50 per year or even $1,000 per year. And people don't like change being forced based on the inability to acquire proper insurance coverage.

Detailing the costs and arguing the future increases is in my opinion a waste of time when you compare the mitigation grants available to you. It's all up to your community leaders from your city council and mayors office to your parish (county) and governors office. In my opinion If you would take away the wasted spending that your elected officials feel is in your best interest and invest that into individual homeowners with state fixed contractor prices to include quality control measures you would see more wide spread mitigation that makes a difference. In my neighborhood after the 2016 floods and counting only 200 homes only 10 elevated. That's 10 out of 200 or 5% of the total area community. For the 5% that elevated their homes could actually be insurance for less than $350 per year while the other 95% will have to pay more per year until they reach a break even point for the next disaster. I'll make it very clear on how the programs will calculate your increased costs to live in your floodway. But until then, it's your responsibility to determine which method you want to follow regarding your mitigation.

Look for a full report on this issue soon.