By Murray Wennerlund published 8-8-2024 updated 12-9-2024

|

|

|

By Murray Wennerlund published 7-12-2018 updated 7-14-2018

By Murray Wennerlund published 7-12-2018 updated 7-14-2018

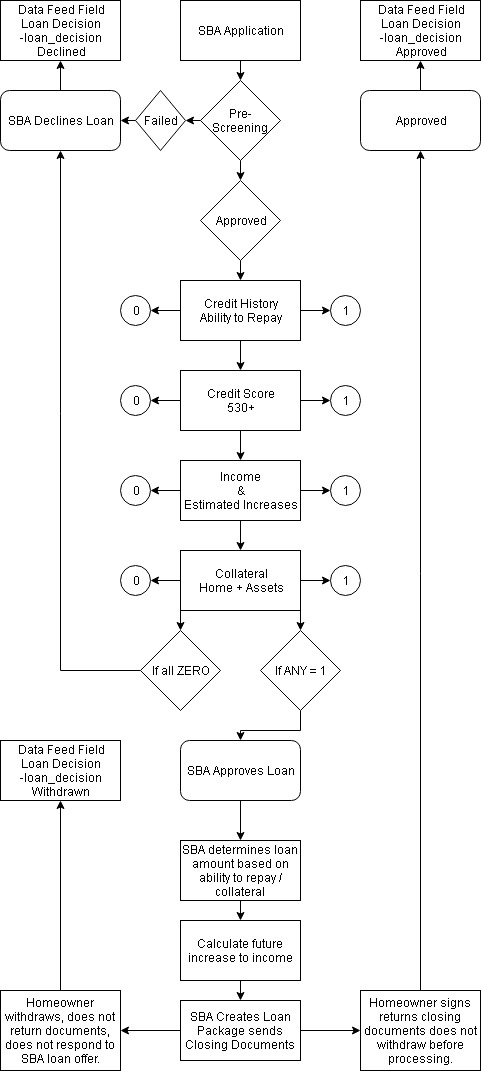

The Unofficial SBA Loan Processing Flowchart that identifies why people that cancel their loans are always shown as approved.

Once approved and your SBA loan is processed the data feed that the SBA offers other agencies will always show your total approved SBA loan amount and the word approved.

You can not be declined an SBA loan after you successfully passed pre-screening unless you score all Zeros in the process flow.

You can not withdraw from the loan program once your closing documents have been signed, returned and processed by SBA.

You can never get the data feed updated from Approved to Cancelled because the SBA Data Feed does not offer that option. You are forever approved for the highest approved amount. Yes, it appears if you ask for a lower loan amount the SBA data feed will always show your highest qualifying amounts in the data feed.

SBA Process Flowchart developed by Murray Wennerlund for the Louisiana Task Force to review as exhibit for waiver of usage of data feed when disaster victim provides other proof loan has been cancelled. SBA will confirm all 61 versions of it's "Cancelled Letter" types. But they will not change the data feed.

This is why it's so difficult to fight your SBA Loan DOB when you have a letter from SBA showing you cancelled the loan but the state does not change your DOB.

This is the flow that is reported to the state OCD-DRU, Restore and IEM Inc.

This is not the official flowchart because I wasn't able to get one so I created this after reading the SBA Standard Operating Manual on Loan Processing.

I'm sure a few minor details are missing but the bottom line is that the data feed provided by the SBA for our states OCD-DRU and Restore people will not ever show your loan status as cancelled.

The option to report a cancelled loan is not part of the application.

I will be asking the Task Force to update policy to allow homeowners that cancelled the loan before receiving assistance the benefit of providing the SBA letter to Restore, OCD-DRU and IEM Inc.

I have confirmed with several people that the SBA will confirm the letter was sent and to what code they issued. This is all we need to provide to the state that the "Assistance" is no longer available to us.

The Louisiana Office of Community Development - Disaster Recovery Unit uses the data feed from the SBA to determine if a loan is available to the homeowner.

This data feed once updated is not changed unless their is an increase in the loan amount.

If the homeowner Withdraws from the SBA Loan Process the Loan amount will still remain in the data feed with the word "Withdrawn".

If a homeowner cancels their loan with SBA and SBA has not disbursed any funds the SBA will cancel the loan in it's entirety. The Data Feed is not updated for a canceled loan.

A canceled loan has a maximum time period of 6 months to be reinstated by the homeowner.

8.3. REINSTATEMENT OF CANCELLED LOANS

Borrowers may request reinstatement of all or any portion of a cancelled loan.

A. Method and Deadline for Requesting Reinstatement: All requests for reinstatement should:

1. Be in writing and be made within 6 months of the date of the cancellation; and

2. Provide justification that we should reinstate the funds.

"If the loan was cancelled in full (no disbursement made) the Loan Officer should also advise the borrower upon approval of the reinstatement request, new loan closing documents may be issued and that the original documents may no longer be valid. "

The Louisiana Office of Community Development Patrick Forbes on April 13, 2018 claimed that if a household would receive HUD CDBG-DR grant funds they may go back to SBA and ask them for money.

According to SBA SOP 50 10, part 8.3 Reinstatement of Cancelled Loans.

"B. Late Reinstatement Requests - General Rule: We will not reinstate funds if:

1. Six months have elapsed from the date of the cancellation or reduction action; or

2. There is no outstanding"

If 6 months have past, we are going 18 months for most SBA loan disaster victims twice that cancelled the loan and thought that was it.

Below you can see another SBA policy that places SBA after HUD and has SBA checking to see if HUD grants could be a duplication of benefits. Allow each department to screen, do not assume a person that applies for a HUD CDBG-DR Grant is going to turn to the SBA to apply for a loan. Even if they did, the DOB concern would not be that of HUD but that of the SBA even if out of delivery sequence.

Other Recoveries: You must also deduct the net amount received, which would duplicate an

SBA loan (e.g. HUD, Community Development Block Grants, etc.).