Question FEMA and your states Emergency Management people about applying for SBA Loans.

Be sure to ask your FEMA people, your state and local government people about HUD CDBG-DR grants.

Share with your political leaders in the first week after your declared disaster about what HUD CDBG-DR grants can do for you.

HUD Guidance on Duplication of Benefit Requirements and Provision of CDBG Disaster Recovery (DR) Assistance

(Resource: HUD Guidance July 25, 2013)

NOTE: It's important that you know from day one working with FEMA will earn you grants, working with SBA will earn you loans that must be repaid.

HUD CDBG-DR is a long term recovery grant program in which GRANTS do NOT have to be repaid.

Learn about your recovery process and find the best path for recover. Learn from other homeowners and from their experiences with federal, state and local government assistance.

No matter what state you are in, the Federal Assistance rules and policies are going to always be the same.

States may ask for slight changes but, for the most part all major policies are fixed in place.

Q: Must an applicant apply for SBA assistance as a prerequisite for receiving CDBG DR assistance?

A: HUD encourages but does not require applicants (i.e., homeowners and businesses) to apply for SBA assistance as a prerequisite to receiving CDBG DR assistance. Further, HUD will not require applicants who have applied for and been offered SBA assistance to accept the SBA assistance as a prerequisite to receiving CDBG DR assistance.

Q: How must a grantee address the situation where an applicant has declined an offer of SBA assistance, and now seeks CDBG DR assistance?

A: Grantees must make the most effective use of their CDBG DR resources and meet the statutory directive that funds be used for "necessary" recovery costs. Grantees must properly size the CDBG DR assistance offered to any applicant in this circumstance, but may use multiple approaches to size the assistance and may vary the approach used for individuals from that used for businesses. Regardless of the applicant or approach, grantees must be able to demonstrate that the amount of CDBG DR assistance is necessary and reasonable consistent with Federal financial standards.

Q: What is HUD's guidance to grantees on establishing criteria and policies for implementing this

guidance?

A: This guidance directs grantees to assess each applicant's circumstance and prevent the duplication of benefits. Grantees must adopt an approach that adequately establishes the basis for CDBG DR assistance and HUD anticipates that grantees will base their approach upon this guidance. Grantees are cautioned against providing 100 percent CDBG DR grant assistance where an applicant has declined SBA assistance without fully documenting the basis for that level of subsidy. Failure to institute an appropriate process to address these cases may open the grantee to programmatic sanctions.

The Department's minimum expectation in this situation is that grantees will incorporate policies and procedures that achieve the following:

- Identify the circumstances under which the applicant declined the SBA assistance

- Establish why CDBG DR assistance is appropriate for the applicant and

- Determine, most commonly through underwriting, the amount of CDBG DR assistance that is necessary and reasonable to assist the applicant in achieving recovery.

Q: Is there an evaluation process that HUD can recommend to grantees?

A: The Department has reviewed PL 113-2, the Disaster Relief Appropriations Act, 2013, which limits the use of funds to "necessary" expenses. Further, HUD has reviewed materials related to OMB Circular A-87, Cost Principles for State, Local, and Indian Tribal Governments (codified, in part, at 2 CFR 225) and has developed the following approach that grantees may opt to use for implementing a duplication of benefit analysis where SBA assistance was declined by a potential CDBG DR beneficiary. The grantee is not required to adopt this approach, but it must have an approach that adequately establishes the basis for any CDBG DR assistance to that beneficiary.

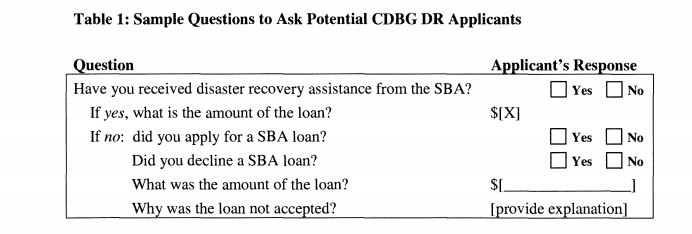

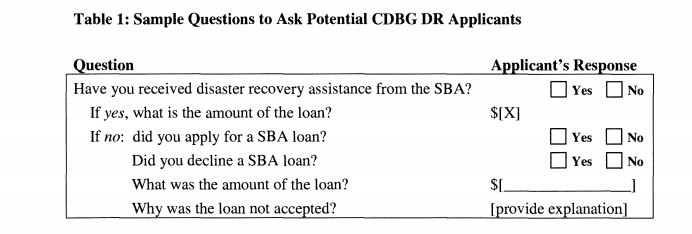

Table 1: Sample Questions to Ask Potential CDBG DR Applicants

Step 2-Grantee's analysis of a declined SBA loan.

The grantee must demonstrate that providing CDBG DR assistance to an applicant that has declined a SBA loan is necessary and reasonable. To demonstrate this, the grantee must develop policies and procedures which describe what circumstances and/or facts, such as the reason for the applicant's decision to decline the SBA loan offer that the grantee will use to determine that CDBG DR support is a necessary and reasonable recovery expense. These policies and procedures must take into account the necessary and reasonable cost principles defined at 2 CPR part 225, Cost Principles for State, Local, and Indian Tribal Governments. Specifically, Appendix A(C)(l) states, "To be allowable under Federal awards, costs must ... be necessary and reasonable for proper and efficient performance and administration of Federal awards." Appendix A then defines a cost as reasonable if" ... in its nature and amount, it does not exceed that which would be incurred by a prudent person under the circumstances prevailing at the time the decision was made to incur the cost. "

Grantees must also make decisions about which types and amount of costs items are necessary and reasonable. This requirement applies to a grantee's costs in administering its disaster recovery program, as well as the ultimate uses of the funds by the grantee. Following the guidance in 2 CFR part 225, grantees should consider the following in determining reasonableness of a given cost:

- Whether the cost is of a type generally recognized as ordinary and necessary for the operation of the disaster recovery program.

- The restraints or requirements imposed by such factors as sound business practices arm's-length bargaining Federal, State and other laws and regulations and, terms and conditions of the CDBG DR program.

- Market prices for comparable goods or services.

- Whether the grantee would be acting with prudence by making an offer for CDBG DR assistance in the circumstances considering their responsibilities to the governmental unit, its employees, the public at large, and the Federal Government.

- Significant deviations from the established practices of the governmental unit which may unjustifiably increase the cost to the CDBG DR program.

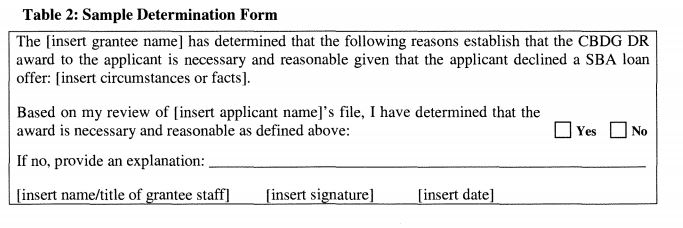

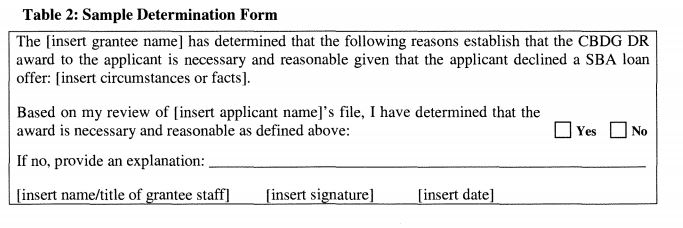

The grantee is encouraged, but is not required, to use the above questions to determine what circumstances and/or facts demonstrate that a CBDG DR award is a necessary and reasonable cost given that the applicant declined a SBA loan offer. Furthermore, these circumstances and/or facts must be described in the grantee's policies and procedures. Applicant files must be reviewed using the grantee's policies and procedures. A determination of why the award of CDBG DR assistance is necessary and reasonable (if the applicant declined a SBA loan offer) must be placed in the applicant's file. Table 2 provides a sample determination form.

Table 2: Sample Determination Form

Resources: